At a Glance

Making and selling fake versions of drugs for treating erectile dysfunction, high cholesterol, hypertension, cancer and other illnesses is big business.

- $75 billion – $200 billion: The current annual revenue lost to counterfeiters

- 13: The number of new drugs not produced in one year because of fake drugs

By the Numbers: Counterfeit Medicines

Reports by Outsourcing-pharma.com and Statista show just how much money counterfeit costs legitimate pharmaceutical manufacturers. Statista estimates the global market for fake drugs alone at $200 billion, accounting for 13 new drugs not being brought to market each year.

Other numbers of note include:

- $100 billion – $431 billion: The estimated sales value lost to counterfeit drugs worldwide in 2020

- 6–28: The number of new drugs not brought onto the market because of the effects of counterfeits through the impact on intellectual property rights

- $103 billion (€92): The amount of money lost to European producers from 2012-2016 for counterfeit products including medicines

- $19.45 billion (€16.5 billion): The amount lost to European pharmaceutical manufacturers, which was second only to clothing, footwear and accessories

- 80,459: The number of pharmaceutical jobs affected by counterfeiters

Sources: Outsourcing-pharma.com, Statista.com

The National Crime Prevention Council has its own statistics on the cost of fake drugs:

- 10%: The amount of all drugs in the global supply chain that are fake

- 70%: The percentage of fake drugs in some countries

- $75 billion: An estimate of global counterfeit drug sales from the Center for Medicine in the Public Interest quoted by the NCPC

- 15,000: The number of illicit drug factories in India accounting for 75 percent of the world’s counterfeit drugs with other producers primarily in under-developed countries

Spotting a Fake

The Food and Drug Administration protects consumers from counterfeit medicines. “Drug safety and quality no longer begin or end at our border. The U.S. government works with foreign regulatory counterparts when possible to disrupt or close illegal operations involving the production and distribution of counterfeits,” the FDA states.

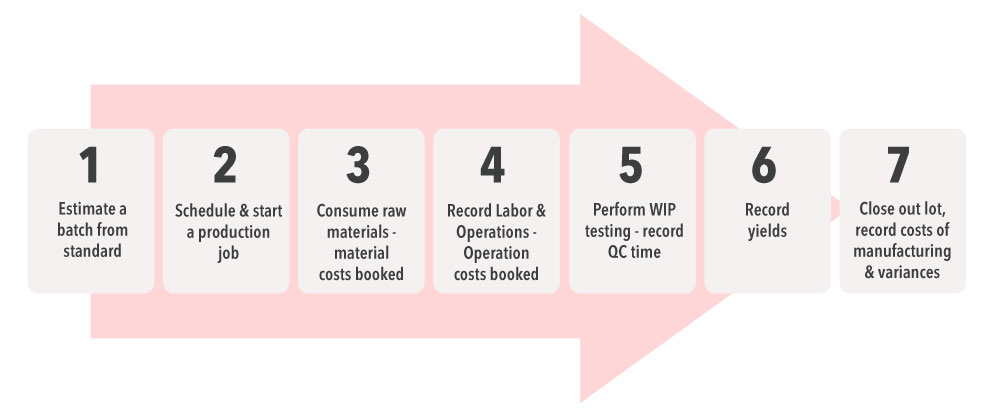

Figure: 1Identifying counterfeit medicine

Identifying counterfeit medicine:

- Packaging different that expected

- New or unusual side effects

- Medicine is available for purchase online

Resellers can protect themselves and their customers by only buying from authorized and licensed companies.

Resellers should also read the packaging. Potential fake products from unlicensed sources can be misbranded, adulterated, contaminated, improperly stored and transported, ineffective or unsafe, the FDA states. Some counterfeits have been spotted without a National Drug Code (NDC) number. Others have misspelled labels.

Among the medicines reportedly being copied and sold in the U.S. during the last five years are:

- Symtuza ® from Janssen Pharmaceuticals (Dec. 24, 2020), used in the treatment of HIV

- BiCNU ®, a cancer-fighting drug from Emcure Pharmaceuticals, Ltd.

- Botox ® from Allergan

- Cialis ® from Eli Lilly

Dangers of Using Counterfeit Drugs

Counterfeit drugs affect more than just legitimate companies: they harm people using them. Citing a 2017 World Health Organization (WHO) study, the OECD iLibrary states the effects on individuals of counterfeit medicines include:

- Adverse—and possibly toxic—effects from incorrect active pharmaceutical ingredients

- Ineffectiveness by not treating the targeted disease

- Loss of confidence in health care professionals and health systems

- Lost income by users from extended illness or death

The OECD report also referenced a 2019 Novartis in Society Report. Forensic tests of counterfeit medicine samples showing patients could be harmed by 90 percent of the counterfeits.

Fighting Counterfeit Drugs

Pfizer, one of the world’s largest drug manufacturers, supports the international “Fight the Fakes” campaign raising awareness of the dangers from using counterfeit medicines. Pfizer states that counterfeit versions of 105 Pfizer products were found in 113 countries. The company works with law enforcement agencies, wholesalers, pharmacies and others to increase inspection coverage, monitor distribution channels and use other methods to fight back.

One way pharmaceutical companies are fighting back is through the Drug Supply Chain Security Act (DSCSA). Enacted in 2013, the act requires manufacturers, contract manufacturers, repackagers, wholesale distributors and other meet compliance requirements.

A large part of this involves labeling.

For example, a warehouse receiving clerk can print labels after receiving raw materials but before putting them away.

Using Wave label printing, labels are available before workers run the work order on a mobile device. Workers then attach the labels during picking instead of after picking. Label printing options include:

- According to the number of cartons on a single work line

- With different sequences such as carton and pallet labels

- Creating a unique serial shipping container code (SSCC) for each carton and including it on the label

- Creating globally usable GS1-compliant numbers for bills of lading and SSCCs

Using Labels to Combat Counterfeiting

Among the labeling and packaging methods used to fight counterfeiting are holograms, 2-D barcodes, radio frequency identification tags (RFID) and packaging features that are either visible (overt) or hidden (covert).

NeuroTags, which makes these types of tags, states that it is easy for counterfeiters to make simple holograms and copy legitimate images. Luminescent topcoats revealing patterns and colors under special lighting are difficult to imitate, making it a good anti-counterfeiting solution for pharmaceutical products.

Smart Labels—also known as Smart Tags—have an RFID tag with a computer chip, antenna and bonding wires under a conventionally-printed barcode label. Among their benefits for the pharmaceutical industry —beyond being difficult to copy—is their ability to track temperatures. This is critical for some medications, such as the current Covid-19 vaccines from companies such as Pfizer and Moderna.

Another benefit of smart label technology is letting companies track items in real time. “It fulfills the requirement of tracking objects remotely, effectively, and most importantly at an affordable price,” Packaging Strategies.com states.

Combined with Microsoft Dynamics 365 Supply Chain Management, these types of labels make it difficult for counterfeiters to substitute cheap, ineffective and dangerous knock-offs for real medications.

D365 Supply Chain Management functions let companies track products from the moment raw materials arrive in the warehouse, through the production process and on to the sales floor.

Customers with equipment required to read the labels—and personnel trained in what to look for—will be able to distinguish legitimate goods from the fakes.

Summary

Counterfeiting pharmaceuticals costs the industry billions every year. It affects not only sales profits but intellectual property rights. Combining different types of labels such as Smart Tags with inventory tracking software lets pharmaceutical manufacturers know when real goods arrive at their destinations. It also lets them know when someone along the supply chain stole their products and replaced them with fakes.

Get a consultation to learn about pharmaceutical industry fraud.