Introduction

Pharmaceutical supply chains continue to evolve even as the worldwide Covid-19 pandemic shows signs of improvement in some countries (the U.S.) and worsening in others (India). Key trends include:

- Geographically diverse suppliers

- Sustainable sources of raw and packaging materials

- Increasing use of computer technology to help manage companies

How chief financial officers (CFOs) and chief operating officers (COOs) of pharmaceutical companies respond to growing demands while facing labor shortages in areas hard hit by the pandemic largely depends on their ability to obtain raw materials and then manufacture and ship finished products.

Reports in SupplyChain Brain, EazyStock and Manufacturing.Net state that supply chain management trends likely to influence the pharmaceutical supply chains near term include increased use of:

- Diverse (i.e., multiple) suppliers for improved resilience

- Sustainable supply chain sources

- Enterprise Resource Planning (ERP) and pharmaceutical warehouse management software (WMS) to improve management of the overall business, including the supply chain

- Artificial intelligence (AI) to boost productivity and decrease errors

- Cloud-based technology to permit scaling small and medium businesses as they grow using mutable

- Industrial Internet of Things (IIoT) to track products ranging from individual batches to complete orders

- Robots and other forms of automation to perform labor-intensive tasks

- Flexible supply and delivery sources permitting personalized shipments

- Layering technologies to eliminate data silos and create actionable data across technology platforms

- Blockchain to improve transparency in data sharing using immutable databases Smart contracts that automatically execute when a set of conditions is met

Geographically Diverse Suppliers and the PSC

Having a geographically diverse source of raw materials such as active pharmaceutical ingredients (APIs) becomes important in a world proven so susceptible to pandemics. Companies whose primary suppliers are in India (currently suffering an uptick in coronavirus cases), for example, may find their suppliers are short-handed and unable to fulfill orders. CRB Group states supply chain challenges from rare events also include:

- Transportation issues and disruptions

- Adding counterfeit material into the supply chain

- Site closures

- Lack of coordination and traceability causing inventory build-ups or shortages

According to GoMarketWise, having a diverse supply chain also provides:

- Access to innovation outside your organization

- Flexibility to respond when market conditions change

- Competitive pricing at local levels

- Specialization many small to medium businesses (SMBs)

Sustainability in the Pharma Supply Chain

Many organizations across all business sectors are looking at climate-smart supply chain planning because of the effect of climate change on the availability of resources and materials, a report in All Things Supply Chain cites a Harvard Business Review study claiming companies advocating for sustainability grow 5.6 times faster than brands that don’t.

One area impacted by sustainability is product packaging. A study by Pelican BioThermal quoted in The LoadStar states that 48% of respondents claim to be looking for packaging that is recyclable or can easily enter the waste stream. Larry St. Onge, president of DHL’s global sector, life sciences and healthcare is quoted as saying his customers’ packaging would become a strategic priority in the near future. “This is of utmost priority because 25% of the global 8.3 billion tons of plastic produced originates from packaging and more than 90 countries have imposed bans on single-use plastic.”

“A more sustainable pharmaceutical supply chain (PSC) should be implemented to match future operations and management of the pharmaceutical products across the entire life cycle,” a look at Pharma Industry 4.0 on ScienceDirect states.

Further restricting the adoption of sustainable processes in the PSC are high costs and time consumption, enforcement of regulations, a lack of business incentives, lack of objective benchmarks, poor end-customer awareness and other issues.

Increasing Use of ERP and WMS in Pharma

Pharmaceutical companies are increasing their use of enterprise resource planning (ERP) and warehouse management software (WMS) from companies like Microsoft to improve management of the overall business, including the supply chain. Software add-ons automate many previously manual tasks, such as inventory optimization and shipping solutions, EazyStock states.

A report by Grand View Research states the market size for WMS programs is expected to grow from $3 billion in 2021 to $8.1 billion with a compound annual growth rate (CAGR) of 15.3% from 2021-2028 with a CAGR of more than 17% in WMS software alone. The WMS market was $348.6 million in 2016.

Grand View Research cites healthcare as one of the biggest growth sectors as companies seek to increase product output and meet rising customer demand. “A WMS helps reduce lead time, increase product delivery speed and minimize distribution costs,” Grand View states.

Much of the increased demand for pharmaceutical WMS software is expected to come from small- and mid-sized businesses using it on a cloud-based computing system. WMS software, “is widely used as a tactical tool by businesses to meet the unique customer requirements of their supply chain and distribution channel,” the report indicates.

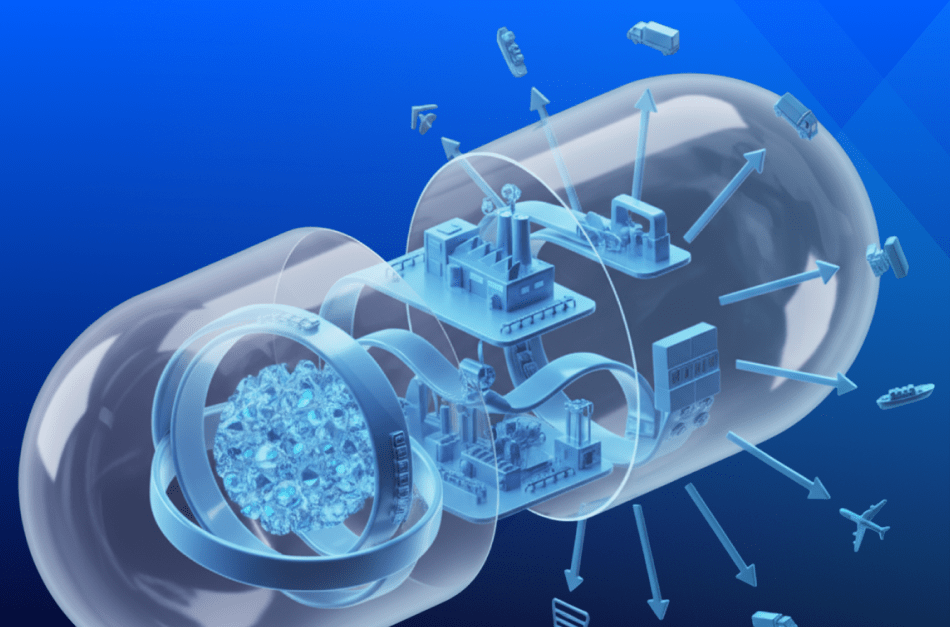

Figure: 1 Recent Trends in Pharmaceutical Supply Chain

Using Robots in Pharma Factories

Robots offer several advantages over human workers in select conditions, a report by TweakYourBiz states. including:

- Increasing worker safety when assembling implants and drugs containing radioactive or biohazardous compounds

- Reducing contamination by having robot-only areas

- Performing repetitive tasks to perfect efficiency, increase productivity and eliminate human error

- Retooling and refitting a robotic ensemble to perform different tasks

- Automating high-throughput screening (HTS) for chemical or biological compounds

- Scanning products to identify potential counterfeits

“Robots provide improved reliability and result in fewer rejects and material waste,” the TWB report concludes.

Smart Contracts and the PSC

Administrative expenses are a significant part of PSC expenses, which add 7% – 8% to the final cost of a pharmaceutical product, a report by Exyte claims. Administrative staff is required to handle invoices and send payments. These processes are automated when using smart contracts that automatically execute using a transactional computing protocol when stated conditions are met.

However, these contracts use blockchain technology to, “verify, validate, capture and enforce agreed-upon terms between multiple parties,” Finextra states.

Summary

As businesses strive to increase their efficiency and performance, increasing diversity in terms of raw materials sources, APIs, using software to help manage operations with robots and other forms of automation on both factory and warehouse floors continue to rank high among emerging pharmaceutical supply chain trends.

Looking to transform your pharmaceutical supply chain? Get a assessment with XcelPros!

References: Supply chain trends to watch