At a Glance

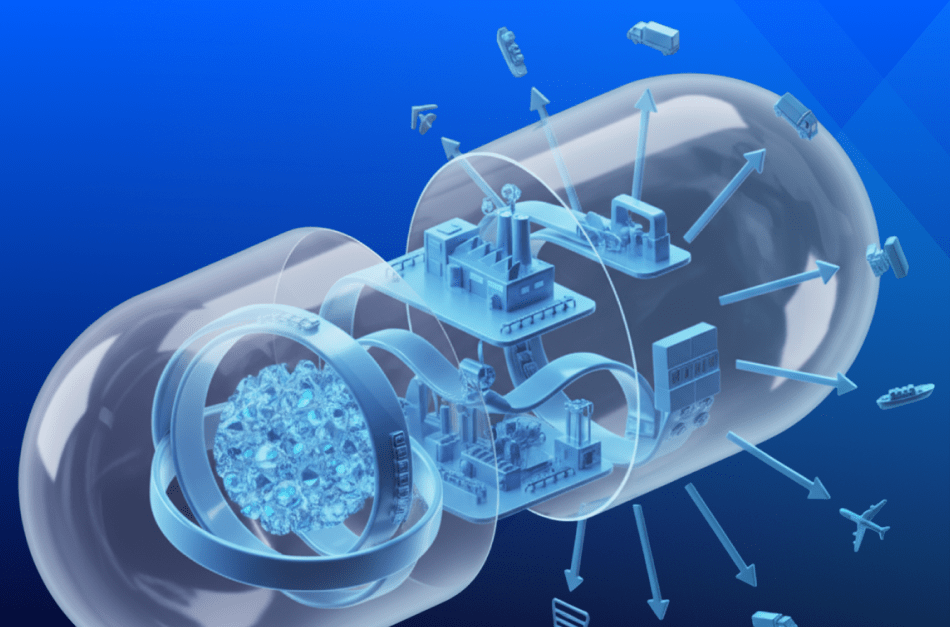

Building a resilient supply chain framework for pharmaceutical companies requires:

- Understanding where the company is now.

- Creating new business relationships with alternate raw materials suppliers, transportation providers, and other essential third-party businesses.

- Weighing the benefits of a robust and versatile pharmaceutical value chain versus the impact on working capital.

Introduction

Pandemics, natural disasters, cyber-attacks, political turmoil, and other actions are beyond a company’s control. Any one or combination of them can thoroughly disrupt a smoothly running supply chain.

Critical supply chain areas getting battered by these disruptions include reduced or non-existent access to:

- Essential precursor chemicals and components

- Production facilities

- Vital workers and managers

- Transportation resources to bring in raw materials and ship out finished products

The unquestionable first requirement to improving supply chain resiliency is having access to accurate data and knowing what to do with the data-driven insights. Data sources such as the Industrial Internet of Things (IIoT) provide real-time information, and applications such as Microsoft Dynamics Supply Chain Management helps users evaluate existing information.

Precursor Chemical Supplies

A 2020 report from Avalere states that U.S. biotech firms making medicines here get their active pharmaceutical ingredients (APIs) from U.S. suppliers – import them or import finished products. These precursor chemicals accounted for $86.5 billion in the U.S. alone during 2019.

One issue U.S. companies are facing is the location of active pharmaceutical ingredient (API) manufacturers. According to the U.S. Food and Drug Administration (FDA), the top four places are:

- 1.U.S. – 28% (510 facilities for FDA regulated drugs)

- 2.European Union – 26%

- 3.India – 18%

- 4.China – 13% (230 facilities for FDA regulated drugs)

Figure: Percentage of API Sources in U.S. Dollars

Figure: API manufacturing facility locations

Canada and the rest of the world produce the remaining 20 percent of APIs used in medicines. Also, the FDA report states India, the EU, and the rest of the world have 1048 facilities making FDA-regulated drugs.

Adding to the importance of having resilience in the pharmaceutical supply chain are potential supply chain disruptions caused by using overseas suppliers. These include recalls, such as two from China cited by the FDA within the last six years.

One way to counter a dependency on foreign API supplies is by using advanced technology to produce chemicals and medicines at lower costs, the FDA suggests. Using the continuous manufacturing (CM) process to make finished products instead of producing batches with gaps between steps can be more effective.

Another method of reducing reliance on foreign API suppliers is using advanced technology. Newer methods producing APIs and finished dosage forms (FDF) helps in supply chain management in the pharmaceutical industry. The ability to rapidly respond to changes in demand, using smaller physical footprints that require smaller facilities, helps reduce pharmaceutical manufacturing costs potentially, offsetting overseas production advantages. High tech production methods, such as those in smart factories, also tend to have lower environmental impacts.

Pharmaceutical companies considering boosting their pharmaceutical value chain using this method can get help from the FDA. The FDA has an Emerging Technology Program (ETP) described in “Advancement of Emerging Technology Applications for Pharmaceutical Innovation and Modernization Guidance for Industry.”

The FDA is also working on a framework to develop miniature mobile manufacturing “Pharmacy on Demand” platforms to produce essential drugs at or near the point of care. This method, while requiring capital costs, provides the means of eliminating delivery costs.

Risk Sources

Before making changes to the current supply chain, CFOs should look at four primary sources of risk:

- Sourcing of APIs and other raw materials risks. Counter risks by locating secondary suppliers and establishing working relationships with them.

- Staffing and transportation risks. Consider having access to remote workers plus multiple methods of delivering finished products to customers.

- Inventory risks. Contrast cash flow needs with inventories to be able to withstand short-term disruptions while also accounting for perishability.

- Distribution risks. Be able to use multiple methods to deliver finished products to customers. Consider outsourcing part of the distribution to withstand problems in that area.

Strategic Questions

Before investing in building a resilient supply chain, CFOs would want to know:

- How can we obtain the most accurate data on what we currently have? Is investment in IIoT sensors and other technology warranted?

- What are our priorities based on what we have learned from the current pandemic? Is digitizing our data stream the top priority, or is securing a second or third API source more critical?

- How do we balance internal conflicts? What will we do if a secondary API source that can deliver in the event of a natural disaster is more expensive than our primary source that cannot provide when we need the raw materials?

- How do our risks integrate with risks from our third-party partners? How will a disaster impact their ability to supply critical products or services we need?

- What do we consider a resilient supply chain? How much impact on near-term profitability is acceptable if we ensure that we can continue operations in the event of a significant supply chain disruption?

By the Numbers

$16 trillion (i.e., $16,000,000,000,000): Estimated total cost of the Covid-19 pandemic in the U.S. alone.

$85 billion (i.e., $85,000,000,000) lost by the Nasdaq Biotech Index in the week ending March 6, 2021, its third weekly loss in a row.

$242 million (i.e., $242,000,000) lost by the Health Care Select Sector SPDR Fund (XLV) in the week ending March 6, 2021, bringing the total loss to date to $1.68 billion

Strategies for Greater Supply Chain Resilience

Figure: 1A roadmap to digital transformation to a resilient supply chain

According to a recent Deloitte article, CFOs can reduce their chain disruptions and improve their supply chain resilience by using these strategies:

- 1. Identifying and mitigating their most significant supply chain weaknesses. Questions to consider include: Where are your API manufacturers located? Are there alternative sources able to deliver the required quantities when needed? Are the raw material sources within an acceptable range of the production plants? Identifying these alternative suppliers helps ensure a more continuous input of raw materials.

- 2. Prioritizing investments in the supply chain infrastructure to ensure significant delays do not occur when disaster strikes. Technological improvements supporting product storage and movement (e.g., Microsoft Dynamics Supply Chain Management) can make processes more transparent and improve efficiency in financial transactions and information exchanges.

- 3. Balancing the supply chain investments with competing company requirements, such as costs and services. Deloitte cites, “managing working capital while restarting operations and rebuilding inventory as one major challenge of a supply chain disruption.”

- 4. Creating a playbook to handle the causes of supply chain disruptions.

- 5. Implementing the updates from the standpoint of cost, speed, and efficient operation. The Deloitte report states that supply chain leaders should work with CFOs to determine the effects of supply chain changes on their working capital.

Before Making Any Decisions

Before making changes to their current supply chain, CFOs, chief technology officers, and other executives should consider:

- Evaluating where the current pharmaceutical supply chain stands.

- Creating a plan or series of methods for sourcing alternate raw materials, workers, and production facilities should any natural or human-made disasters strike.

- Analyzing the cost versus benefits of making the current pharmaceutical value chain more robust and resilient.

Looking for a digital transformation to build a more resilient pharmaceutical supply chain? For a consultation